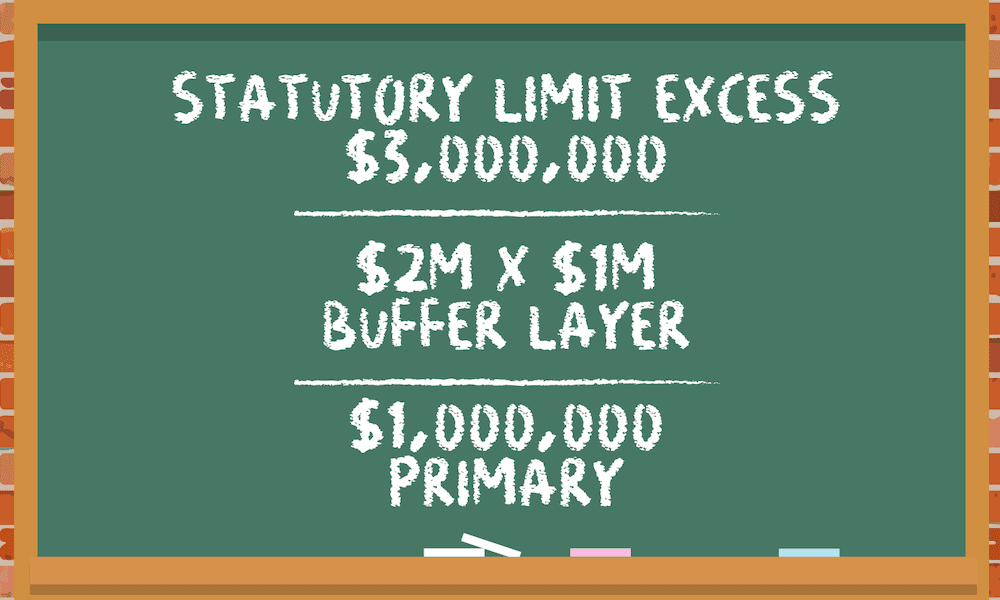

Buffer Layer – A buffer layer is any layer of coverage that fills the void between a primary layer and excess layer(s) of coverage. This has become a more common term in the casualty insurance industry in recent years as markets have continued to harden and carrier appetite has become more restrictive. For example, a buffer layer may be required when an excess carrier is only willing to attach at a $2M attachment point, but the primary policy only offers a $1M limit. The difference between the $1M primary and the $2M excess attachment would need to be made up from a $1M buffer layer.

Ultimately, the excess carrier determines when a buffer layer will be required. This often varies by carrier appetite but also can be a product of the risk profile of an individual company. For example, higher attachment points for excess carriers often accompany higher hazard underwriting risks. From a liability standpoint, this is often industry driven, ie. Contractors, trucking firms, etc. However, the size of risk can also play a crucial role in underwriting appetite, such as total fleet size.

At the end of the day, when you have a $1M primary liability limit and your excess policy will not drop down to the $1M attachment point, you will need to look to a buffer layer policy to make up the difference between the primary and excess layers of coverage.